1 Neurological diseases where the disability level is certified to be of 40 or more-. Neurological Diseases where the disability level has.

Deduction Under Section 80ddb For Medical Treatment Of Specified Diseases How To Earn Money Through Small Savings

Diseases or Medical Ailments Specified under Section 80DDB.

80ddb treatment of special diseases. Individuals and HUFs who are residents of. Section 80DDB of the Income-tax Act 1961 provides deduction for specified diseases covered under Rule 11DD. Introduction Section 80DDB provides a deduction for the expenditure actually incurred on the treatment of specified diseases for self spouse children parents and siblings.

This type of deduction is covered in Chapter VIA of the Income Tax Act 1961. Tax Deduction based on Medical Treatment of specified Diseases or Ailments In Tax Views 2613 Income Tax Act provides relief to taxpayer based on medical treatment of. Section 80DDB specifies the following medical ailments and diseases for which tax deductions can be availed.

Allowed to Resident Indians. Dependant shall mean spouse children parents and siblings. Can be claimed by an Individual or HUF.

However this deduction includes the expenses incurred on the treatment of only special diseases. Accordingly section 80DDB covers medical treatment for. Following are the specified diseases.

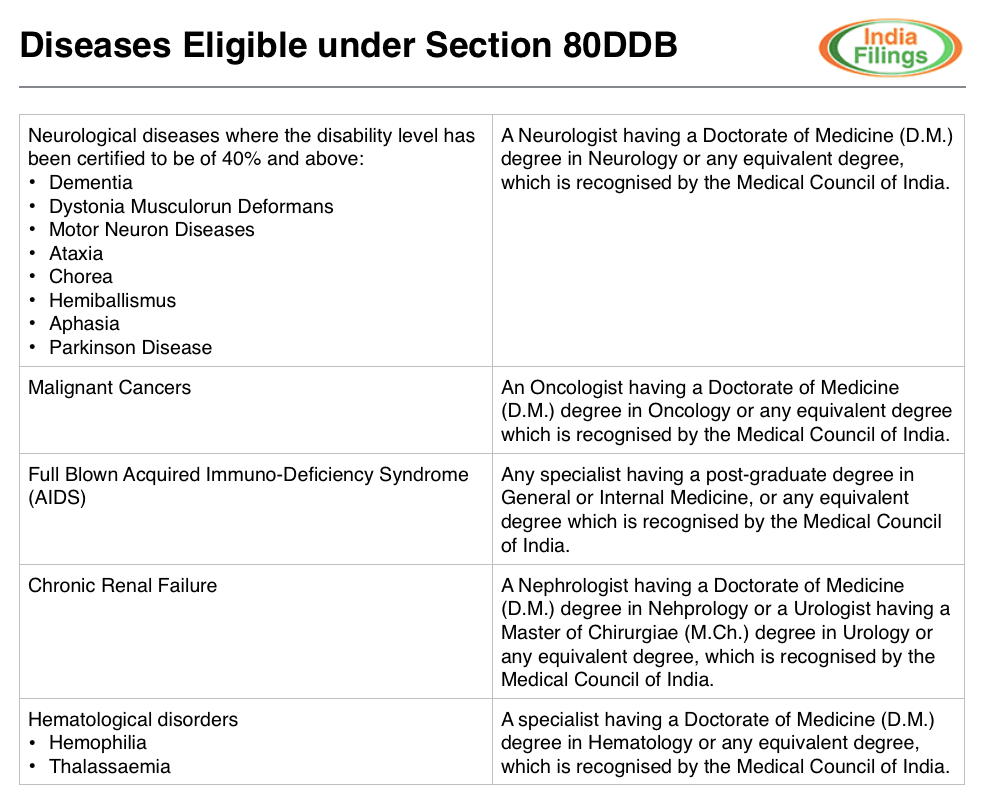

Neurological Diseases with a disability of at least 40. For senior citizens above the age of 80 the actual amount paid for medical treatment or Rs 60000 whichever is lower. I Neurological Diseases where the disability level has been certified to be of 40 and above.

The list of diseases are separately prescribed as per Rule 11DD of the I T ActThus only following. The deduction under section 80DDB for treatment of specified diseases under Income Tax Act provides relief to a tax payer who is spending on patient who is his dependent relative suffering from any one of the specified disease. The list of specified diseases is covered by Rule 11DD of the income tax.

This exemption can be claimed under Section 80DDB from the gross total income prior to the calculation of taxable income which results in lower tax liability due to reduced taxable income. In case of Individuals- Self or a disabled dependent can be Spouse Children Parents BrotherSister siblings In case of HUF -. According to the Tax Department the following are the eligible diseases or ailments that are taken into consideration for claiming tax deduction under section 80DDB.

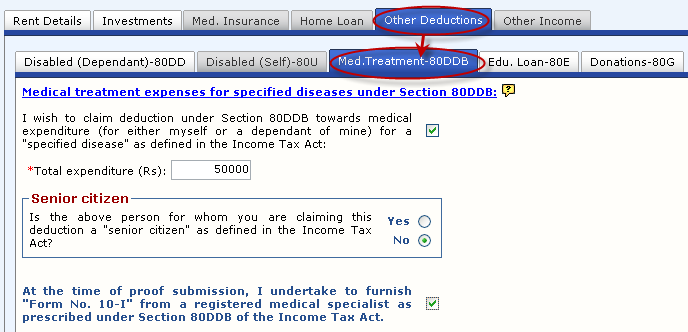

Diseases or Medical Ailments specified under Section 80DDB. Section 80DDB provides that if an individual or an HUF has incurred medical expenses for treatment of specified disease or ailment such expense is allowed as deduction subject to such conditions and capped at such amount as specified under Section 80DDB. The maximum amount of deduction allowed from gross total income on condition that no medical reimbursement is received from any.

Deduction under section 80DDB can be availed towards medical expenses incurred or amount paid for the treatment of diseases like neurological diseases where disability level certified is above 40 malignant cancers full blown Acquired Immuno-Deficiency Syndrome AIDS chronic renal failure and specific hematological disorders Hemophilia. When taxpayer has spent money on treatment of the dependant. Section 80DDB speaks of deductions in respect of expenses incurred for medical treatment of specified diseases or ailments.

Often people confuse Section 80U Section 80DD and Section 80DDB when claiming the deduction benefit. Diseases that are neurological in nature such as. According to the Income Tax Act the following are the eligible diseases or aliments that are taken into considerations for claiming deduction under section 80DDB of Income Tax Act for AY 2021-22.

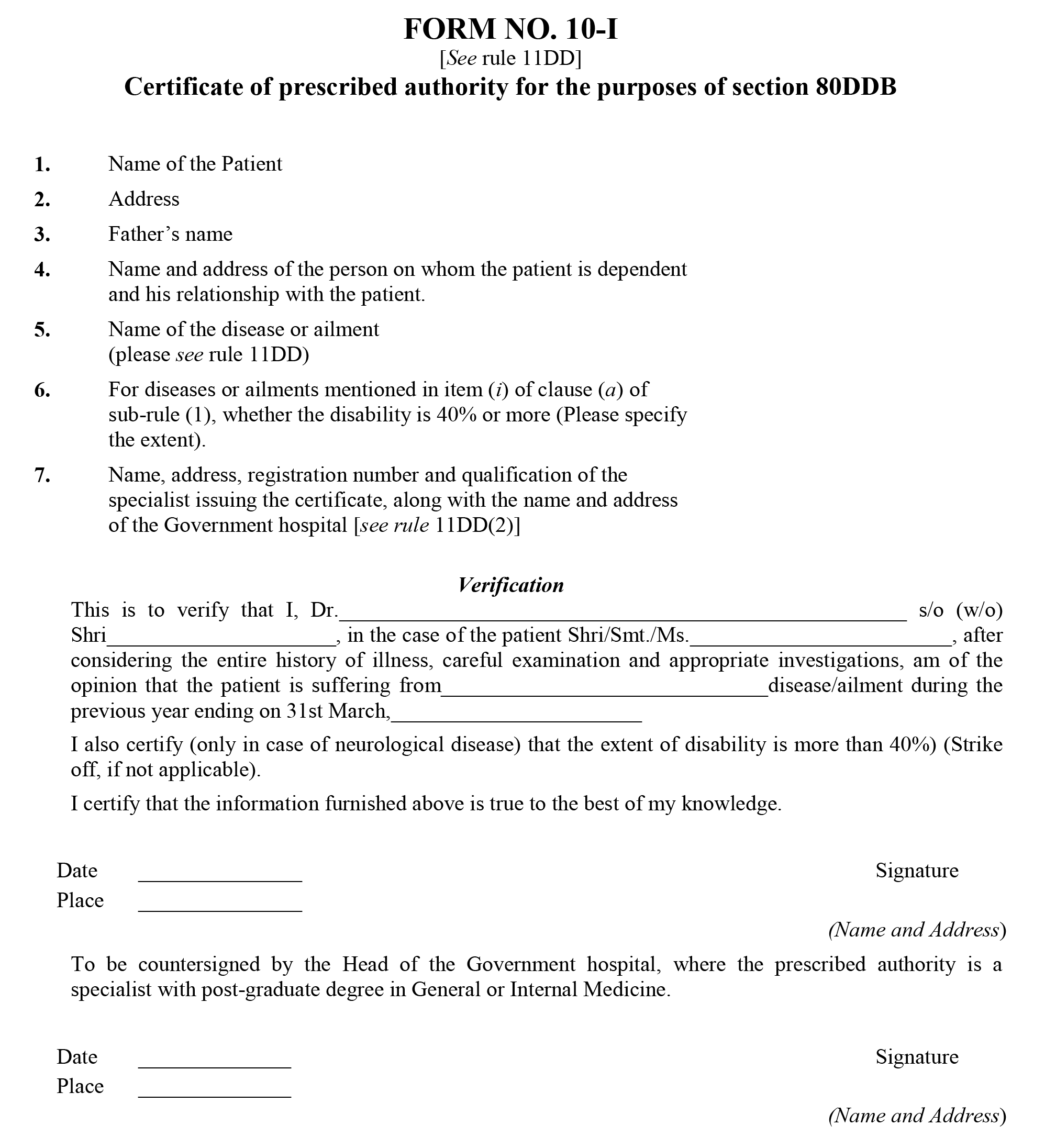

Following are the specified diseases. Certificate for Claiming Deduction According to the amendment to section 80DDB which was made in 2015 the. Deductions of expenses on medical treatment of specified ailments such as AIDS cancer and neurological diseases can be claimed under Section 80DDB.

The Deduction under section 80DDB is available to all Residents Individual or HUF for medical treatment of specified disease or ailment for self or dependent relatives. Diseases Covered under Section 80DDB Taxpayers can claim deductions for the treatment of a wide range of specified diseases which include. Medical treatment of specified ailments under section 80DDB.

Medical expenditure must be done either on selffamily members as defined under law andor parents who are aged 60 years and above for the treatment of diseases or ailments You can claim Deduction under section 80DDB in respect of medical treatment following conditions must be satisfied. 1 For the purposes of section 80DDB the following shall be the eligible diseases or ailments. Under Section 80DDB a deduction is applicable if incurred expenses are on the treatment of specified diseases.

1 Neurological diseases where the incapacity level is certified to be of 40 and more -. Under Section 80DDB of the Income Tax Act 1961 taxpayers can claim deduction for medical treatment of certain specified ailments for self or dependent. List of diseases as covered under Rule 11DD of Income Tax Rules 1962 are as under.

Taxpayer must be resident in India. Deduction under section 80DDB is allowed for medical treatment of a dependant who is suffering from a specified disease listed in the table above.

Section 80ddb Deduction In Respect Of Medical Treatment

Deduction Under Section 80ddb With Faq

Income Tax Deduction For Medical Treatment Indiafilings

Section 80 Deduction Deduction U S 80dd 80ddb 80u Tax2win Blog

80ddb Section 80ddb Income Tax Act Deduction Certificate Forms

Section 80ddb Diseases Covered Certificate Deductions Tax2win

Income Tax Exemption Under 80ddb With Diseases List Sag Infotech

Section 80ddb Of Income Tax Act Diseases Specified Deductions Fincash

0 comments:

Post a Comment