Allowed to Resident Indians. Section 80DDB provides that if an individual or an HUF has incurred medical expenses for treatment of specified disease or ailment such expense is allowed as deduction subject to such conditions and capped at such amount as specified under Section 80DDB of Income.

Section 80 Deduction Deduction U S 80dd 80ddb 80u Tax2win Blog

Under Section 80DDB of the Income Tax Act 1961 taxpayers can claim deduction for medical treatment of certain specified ailments for self or dependent.

Medical treatment 80ddb. For senior citizens above the age of 80 the actual amount paid for medical treatment or Rs 60000 whichever is lower. Accordingly section 80DDB covers medical treatment for major illnesses and diseases and would not cover medical expenses which are common in nature. Can be claimed by an Individual or HUF.

Today we learn the provisions of section 80DDB of Income-tax Act 1961. Sir 80D is a deduction for payments of Medicaid policy and Section 80DDB is a deduction for payment of medical expenses incurred for self spause dependable person and only allowed if you not purchase the mediclaim policy. The citizen of India can claim deduction under this section.

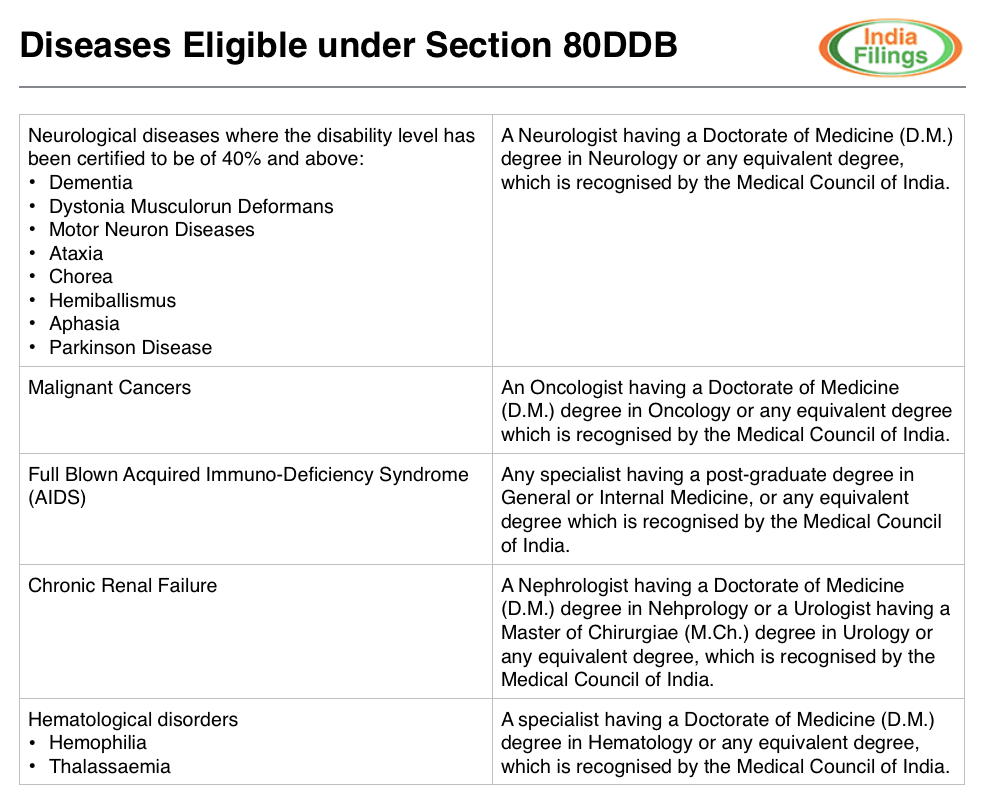

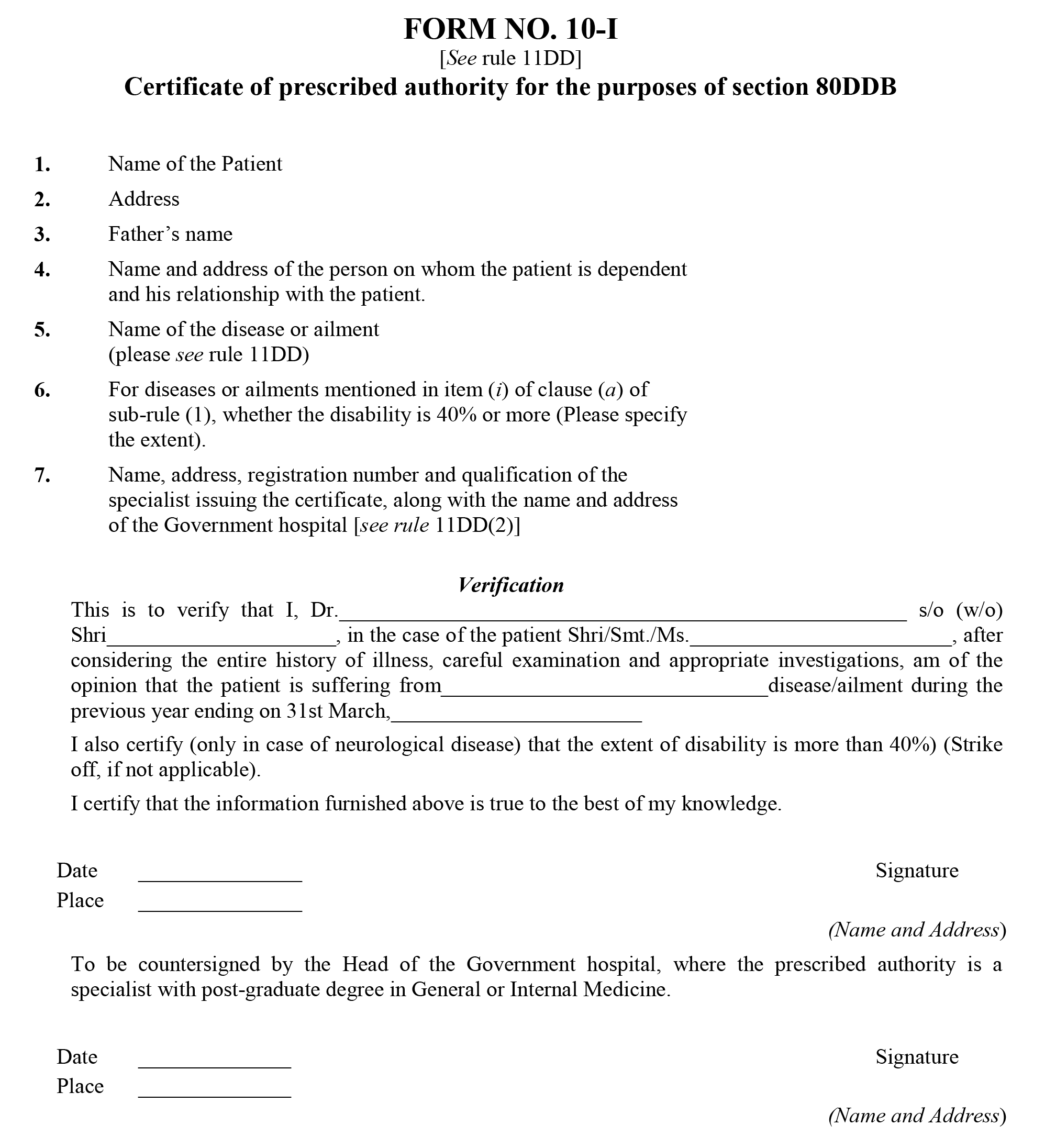

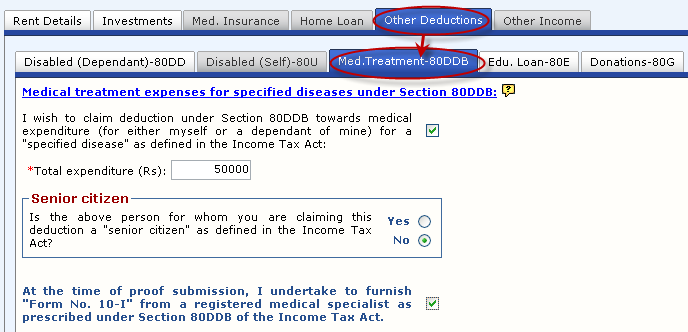

No deduction under section 80DDB shall be allowed unless the assessee obtains the prescription for such medical treatment from a neurologist an oncologist a urologist a haematologist an immunologist or such other specialist as may be prescribed. Under Section 80DDB an individual or HUF can claim tax deduction up to a maximum amount of Rs 40 000 for medical treatment expenses paid during the previous year. Section 80DDB specifies the following medical ailments and diseases for which tax deductions can be availed.

40000 whichever is less. As per section 80DDB of the Act an assessee resident in India is allowed a deduction of a sum not exceeding forty thousand rupees being the amount actually paid for the medical treatment of certain chronic and protracted diseases such as Cancer. For claiming deduction of common medical expenditure you can claim it under section 80D of the Income Tax Act.

Provided that where in respect of any diseases or ailments specified in sub-rule 1 the patient is receiving the treatment in a Government hospital the prescription may be issued by any specialist working full-time in that hospital and having a post-graduate degree in General or Internal Medicine or any equivalent degree which is recognised by the Medical Council of India. This type of deduction is covered in Chapter VIA of the Income Tax Act 1961. Who is eligible for tax deduction on medical treatment Section 80DDB.

In the case of senior citizen the tax deduction amount can go up to Rs 60 000. Amount actually paid or Rs. The list of specified diseases is covered by Rule 11DD of the income tax.

When taxpayer has spent money on treatment of the dependant. Amount actually paid or. Deductions of expenses on medical treatment of specified ailments such as AIDS cancer and neurological diseases can be claimed under Section 80DDB.

Such relief is given under Section 80DDB which provides tax deduction that if an assessee has incurred medical expenses for treatment of specified disease. Diseases or Medical Ailments specified under Section 80DDB. So as words this suggests that tax deductions are often claimed as.

Introduction Section 80DDB provides a deduction for the expenditure actually incurred on the treatment of specified diseases for self spouse children parents and siblings. For medical treatment of specific diseases or ailments tax deductions can be claimed by taxpayers under Section 80DDB. Deduction under section 80DDB is allowed for medical treatment of a dependant who is suffering from a specified disease listed in the table above.

This sort of deduction is roofed in Chapter VIA of the tax Act 1961. Tax Deduction based on Medical Treatment of specified Diseases or Ailments. Diseases that are neurological in nature such as.

No such deduction shall be allowed unless the assessee obtains the prescription for such medical treatment from a neurologist an oncologist a urologist a hematologist an immunologist or such other specialist as may be prescribed First proviso to section 80DDB Quantum of deduction. Section 80DDB speaks of deductions in respect of expenses incurred for medical treatment of specified diseases or ailments. Quantum of Deduction under Section 80DDB.

Medical treatment of specified ailments under section 80DDB. The maximum amount of deduction allowed from gross total income on condition that no medical reimbursement is received from any. Deduction in respect of expenses towards medical treatment Section 80DDB allows tax deduction on expenses incurred by an individual on himself or a dependent towards the treatment of.

Section 80DDB of IT Act 1961-2020 provides for deduction in respect of medical treatment etc. Chapter VI A Section 80DDB of the Income Tax Act states that any individual or a member of a Hindu Undivided Family HUF is allowed tax deductions if medical charges are incurred for the treatment of a specific disease or. Under Section 80DDB of the tax Act 1961 taxpayers can claim a deduction for medical treatment of certain specified ailments for self or dependent.

Income Tax Act provides relief to taxpayer based on medical treatment of specified diseases or ailments. Often people confuse Section 80U Section 80DD and Section 80DDB when claiming the deduction benefit. Recently we have discussed in detail section 80DD deduction in respect of maintenance including medical treatment of a dependant who is a person with disability of IT Act 1961.

Income Tax Deduction For Medical Treatment Indiafilings

80ddb Section 80ddb Income Tax Act Deduction Certificate Forms

Deduction Under Section 80ddb With Faq

Section 80dd Deduction For Expenses On Disabled Dependent Tax2win

Section 80ddb Diseases Covered Certificate Deductions Tax2win

Section 80ddb Deduction In Respect Of Medical Treatment

Deduction Under Section 80ddb For Medical Treatment Of Specified Diseases How To Earn Money Through Small Savings

Deduction Under Section 80ddb For Medical Treatment As Per The Income Tax Rules 11dd With Automated Form 16 Part A B And Part B For The Financial Year 2016 17 Tdstaxindia Net

0 comments:

Post a Comment