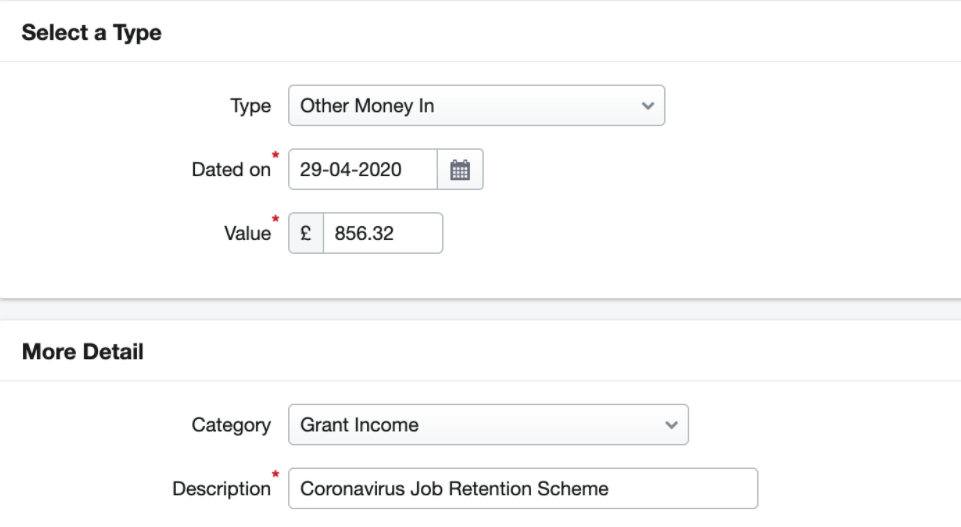

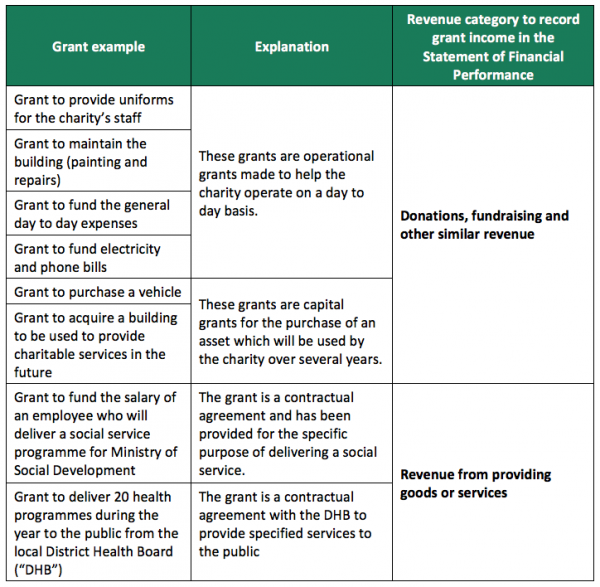

Grant funding can be a complex area in some circumstances as it is common for funding bodies to use the term grant when in reality it is payment for a contractual obligation. In the Account Type dropdown scroll down to Income and select Other Income.

How To Explain A Grant Received Under The Coronavirus Job Retention Scheme Or Self Employment Income Support Scheme Freeagent

Grants should be recognised inter alia on entitlement furlough money will generally be received in the month to which it relates.

How to treat covid grant in accounting. Care should be taken to ensure that any credits of grants to the profit and loss account are done in the correct accounting. Accounting for COVID-19 government stimulus measures Initial and additional cash flow boosts. SSAP 4 concludes that if accountants simply follow the tax treatment and write off the whole grant to the profit and loss account there are occasions when doing so will result in an unacceptable departure from the principle that government grants should be matched with the expenditure to which they are intended to contribute SSAP 4 paragraph 7.

A grant of land the company chooses an accounting policy to be applied consistently to recognize the asset and the grant at either the fair value of the nonmonetary asset received or the nominal amount paid which is zero in most cases. Per the AIPB American Institute of Professional Bookkeepers Proceeds can be used for such purposes as providing sick leave to employees unable to work due to the direct effect of COVID-19 maintaining payroll during business disruption or a substantial slow down meeting increased costs of materials due to disruption of the supply chain making rent or mortgage payments and repaying. Such income must be matched with the related cost in a reporting period.

Accordingly government grants treated as income must be recognized in the PL statement. In the absence of explicit US. GAAP and consider applying that guidance by analogy according to FASB ASC 105.

However the business support funding being made available to mitigate the impact of Covid-19 does not fall into this category and will be outside the scope of VAT. Emergency financial support such as the Self-Employment Income Support Scheme SEISS and Small Business Grant Fund SBGF are subject to Income Tax and Self-Employed National Insurance. Under the Accounting tab in the left-hand navigation menu select Chart of Accounts then click the Add a New Account button.

To record the grant. Generally accepted accounting principles GAAP on the accounting for government grants to business entities. An accruals accounting method the income will be derived when the right to the government payment arises.

In ACCAs view most grants provided by the government in respect of Covid-19 will be treated in the same way regardless of whether the performance model or the accrual model is adopted by the entity ie the grants are recognised immediately in profit or. Revenue confirmed that the EWSS is different from the TWSS in that it is a payment to the employer. While other set of grants must be treated as income.

The employer receives 10000 in EWSS payments then this is treated as taxable grant income of 10000. COVID Business Rates Grant Accounting Treatment. There is no explicit guidance within US.

A cash accounting method the income will be derived when the government payment is received. How should the 10k business rates grant to treated in the accounts. Grants Grants including the Coronavirus Job Retention Scheme furlough should be treated in accordance with SORP module 5.

Normally a grant would be accounted for on the PL in the same period as the expentiture but in this instance there is no linked expenditure. Entities must select an accounting policy for coronavirus related grant income by choosing what constitutes a class of grant income and then whether they will use the performance or accrual model for each class noting there may be a difference in timing of income for any grants that have performance conditions spanning the year-end. Although the foundational rules for US.

Cash Boost is recognised as income when the entity is reasonably assured that it will comply with the conditions attaching to it and the grant will be received AASB 1207. Now head to the Transactions page. GAAP entities should first look for guidance for a similar transaction within US.

Accounting for Cash Boost For-profit entities must apply AASB 120 Accounting for Government Grants and Disclosure of Government Assistance. Financial reporting were designed to be applied across a wide range of occurrences it would have been difficult for any standard setter to envision the number of lease concessions caused by the pandemic or the. As part of its response to COVID-19 the Australian Government in March 2020 announced various stimulus measures to ease the burden experienced by businesses as a result of the economic fallout from the coronavirus lockdown and social distancing measures.

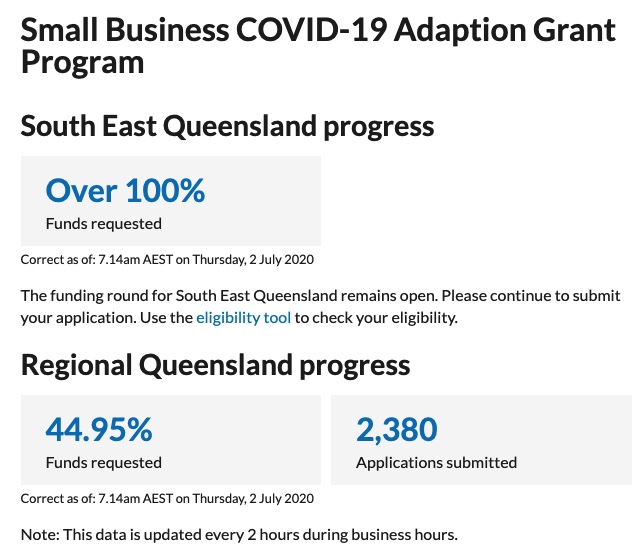

Hi UNCM You can record this on a bank deposit by going to the New Bank deposit. Generally you dont have to pay GST on grant funding unless you provide something of value in return for the payment. However according to research by GoSimpleTax 46 of sole traders have admitted that they thought they wouldnt have to include coronavirus-related grants in any tax returns.

On the deposit select the date and account this was deposited into under Account and then scroll to Add funds to this deposit and enter the grants account you have created under Account and enter the amount and no VAT. Enter a name that youll easily recognize like EIDL grant Click Save. It is a taxable grant and a deduction is available for the portion of wages supplemented by the EWSS.

The coronavirus pandemic has led to numerous financial reporting challenges for CPAs that didnt seem to have easy answers in US. Thus grants that have attributes similar to those of promoters contribution must be treated as a part of the shareholders fund. If a government grant is in the form of a nonmonetary asset eg.

Small Business Grants Qld Covid 19 Adaption Program Open 1 Jul 2020

Charities Services How To Record Grant Income In Your Accounts And In The Tier 3 Performance Report

How To Record Government Grants Onto Xero More Than Accountants

Guiding The Profession Through Challenging Times Chartered Accountants Worldwide

Https Www Accaglobal Com Content Dam Acca Global Technical Fact Tf Cv19 Grants1020 Pdf

Quick Guide Ias 20 Accounting For Government Grants Paul Wan Co

Ifrs Government Grants Grant Thornton Insights

How To Account For Government Grants Ias 20 Youtube

How Do I Account For Receiving The 25k Small Busi

0 comments:

Post a Comment