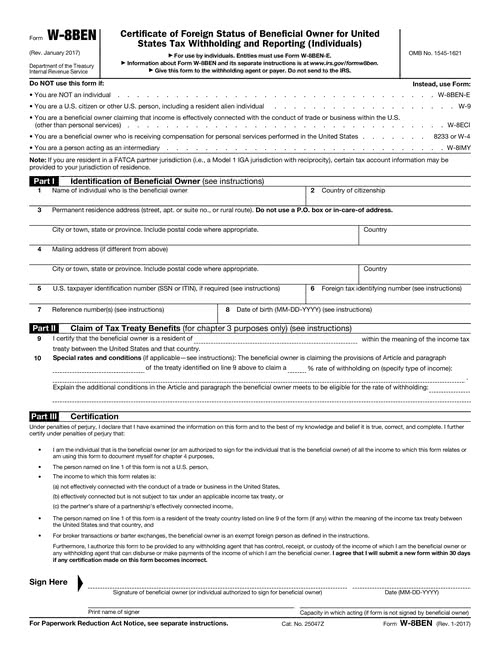

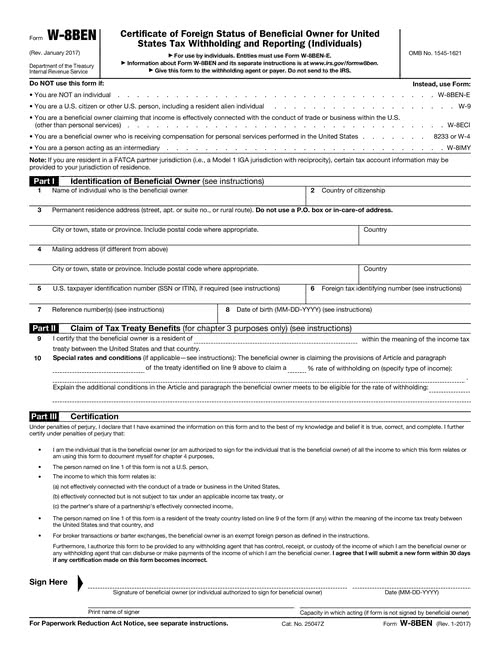

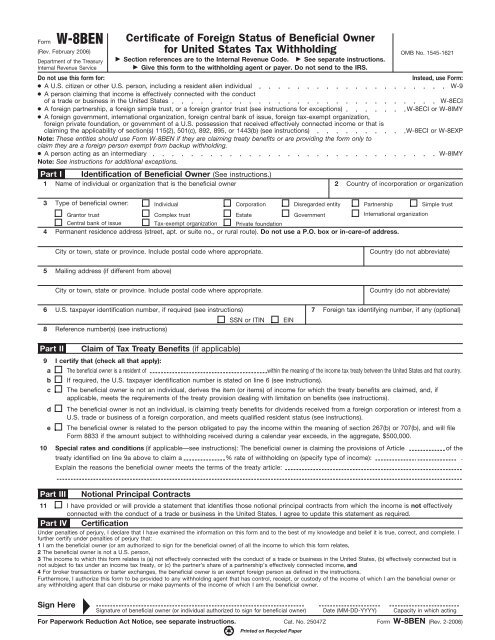

Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in. You are a foreign entity documenting your foreign status documenting your chapter 4 status or claiming treaty benefits.

Topcoder Member Tax Form W 8ben Irs Tax Forms Politics

Instead use Form W-9 to document your status as a US.

W-8ben treaty countries. W-8BEN Tax Form for non-US residents Instructions on how to fill out the W-8 tax form for citizens of countries in. It will assist taxpayers in completing the Form W-8BEN-E and Form 8833 Treaty-Based Return Position Disclosure under Section 6114 or 7701b if required to be filed with the IRS. If your country has a tax treaty with the US.

Download IRS instructions for Form W-8BEN-E Dividend Withholding Rate per Treaty If a country appears in column 1 but column 2 states NA then the statutory rate of withholding applies which is 30. And If applicable claim a reduced rate of or exemption from withholding as a resident of a foreign country with which the United States. That the individual in question is the beneficial owner of the income connected to Form W-8BEN.

I live in Taiwan and chose China as my tax treaty country on my Form W-8BEN. A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. In order to streamline the processing of your tax information please download IRS Form W8-BEN.

Similarly if a country is not listed in column 1 the applicable withholding rate is 30. For instructions and the latest information. Using w 8ben e editable you confirm your status of a nonresident of the United States.

Select Your Tax Form W-8BENW-8BEN-E and click Complete Form Complete the required fields and provide your tax identifying number If your country of tax residency has a treaty with the United States you are presented the option to claim treaty benefits in the Claim of Treaty Benefits Part II section if you wish to do so. However you must check the text of the relevant LOB article to determine the particular requirements of those tests to make a final. Establish that you are not a US.

The purpose of the form is to establish. Entities must use Form W-8BEN-E. Give this form to the withholding agent or payer.

That the individual is a foreign person technically a non-resident alien and not a US. Africa Asia Australia Canada Europe Mexico South America Russia Updated on May 6 2021 On the Tax Forms page you will be asked to Select Your Tax Form. Person including a resident alien individual.

And you provide us with a completed W-8BEN tax form you will be taxed according to the requirements of that treaty. A Form W-8BEN provided by a Non US person will remain valid for a period. W-8BEN also known as a Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding.

For example if I were an Armenian tax resident Id complete line 10 as follows. You must file this form once every two-three years otherwise you will be required to pay 30 tax. In Part I of the form fill in your full name street address and if different full mailing address and country.

I received an e-mail saying that the proof of address I submitted for my address in Taiwan was not sufficient to. The purpose of the form is to certify the country you live in and to confirm you are not resident in the United States. All foreign individuals for whom a treaty applies should notify the payor of their foreign status in order to claim the benefits that they are entitled to.

Do NOT use this form if. In most cases you will do this by filing Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Withholding and Reporting Individuals with the withholding agent. Generally you do this by filing Form W-8BEN Certificate of Foreign.

The form must be provided to your income payer but not to the IRS Internal Revenue Service. Where To Send The Form W8BEN. If there is no treaty 30 percent of your US earnings will be withheld.

The treaty or protocol article describing each of these tests is identified in this table. The Form W-8BEN must be given to the withholding agent to claim a reduced rate of withholding. The beneficial owner is claiming the provisions of Article and paragraph III1a of the treaty identified on line 9 above to claim a 0 rate of withholding.

Claim that you are the beneficial owner of the income for which Form W-8BEN is being provided or a foreign partner in a partnership subject to section 1446. Instead use Form W-8BEN-E. Unless you can provide a proof of address and identity in the Peoples Republic of China or provide other evidence that you are a tax resident of Peoples Republic of China you may not claim Chinese tax treaty benefits.

The US has an income tax treaty in place and FORM W-8BEN will establish your eligibility of treaty benefits. You are a US. If a tax treaty between the United States and your country provides an exemption from or a reduced rate of withholding for certain items of income you should notify the payor of the income the withholding agent of your foreign status to claim the benefits of the treaty.

For example a foreign corporation may not be entitled to a reduced rate of withholding unless a minimum percentage of its owners are citizens or residents of the United States or the treaty country. You are NOT an individual. Citizen even if you reside outside the United States or other US.

If you receive certain types of income you must provide Form W-8BEN to. Do not send to the IRS. When filling out your W-8BEN if your country has a treaty with the US you should complete line 10.

W 8ben For Cdn Beachbody Coaches Sample Irs Tax Forms Government Of The United States

Bercakap Ringan Cara Mengisi Form W 8ben

Irs W 8ben Form Template Fill Download Online Free Pdf

Cara Mengisi Form Tax W 8ben Di Situs Microstock Update 2017 Sangdesstock

Foreign Tax Status W8ben Irs Tax Forms Withholding Tax

Https Www Nordea Com Media 8793

Tax Form W8ben University Of Washington

0 comments:

Post a Comment